| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

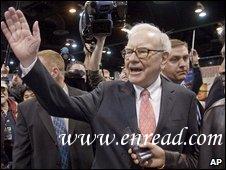

Investor1 Warren Buffett had said the US government is generally taking the right steps to aid economic recovery. 投资者Warren Buffett说美国政府正采取正确的步骤来帮助经济复苏。 Mr Buffett said the US was taking the right steps to aid the economy Mr Buffet2 was speaking to 35,000 shareholders3 of his Berkshire Hathaway company at their annual general meeting being held in Omaha, Nebraska. The value of Berkshire Hathaway's investments fell by nearly 10% in the last year and Mr Buffett's personal wealth shrank by $25bn (£17bn). He told the AGM he expected the company to make further losses this year. Speaking at the opening of the meeting, Mr Buffett said it had been "a very extraordinary year" and the economy had experienced "a financial hurricane". "When the American public pulls back the way they have, the government does need to step in. It is the right thing to do, but it won't be a free ride." But he said the government had reacted well, telling his investors4: "Overall, I commend the actions that were taken." He said the economy had experienced a "financial hurricane" and no one could expect perfection. In an interview for the BBC's Broadcasting House programme, he said that despite short-term pain, in the long run he was optimistic. "It may be much harder to tame inflation a few years down the road because of the things we're doing now to combat the present severe recession so it'll look different but overall it will look better down the road." About 35,000 people are attending the company meeting 'Economic Pearl Harbour' The BBC's North America business correspondent Greg Wood says Mr Buffett is normally greeted by an adoring(崇拜的,敬慕的) crowd at the AGM, know as "Woodstock for Capitalists". But this has been particularly bad year, in which Mr Buffett's legendary5 stock-picking skills seemed to have deserted6 him, says our correspondent, especially when he lost nearly $3bn after buying a large stake in oil company ConocoPhillips just before the oil price crashed. The year was the worst performance in more than 40 years for man known as the "Sage7(圣人,哲人) of Omaha". He has previously8 said he made some "dumb" investment errors in 2008 and compared the US financial situation to an "economic Pearl Harbour". Berkshire's range of investments are seen as a bellwether9(前导,领导者) of the US economy. Tough questions In a change from previous years, half the questions at the meeting were drawn10 from email submissions11(服从,柔和) and posed by journalists rather than stakeholders. Mr Buffett has previously said that neither he nor Vice-Chairman Charlie Munger would know the questions in advance. "We know the journalists will pick some tough ones and that's the way we like it," Mr Buffett said in a letter to shareholders. Some people raised questions on the issue of appointing a successor for 78-year-old Mr Buffet. The company has said it has three internal candidates for Mr Buffett's Chief Executive Officer role and four for Chief Investment Officer. But Mr Buffett told the meeting he would not name a successor to begin following him now as all candidates were already running businesses and those not appointed would possibly choose to leave the company, the Associated Press reported. "It'd be a waste of talent. I don't really see any advantages in having some crown prince around," he said. Despite its troubles, Berkshire Hathaway has fared much better than many other funds in a year of huge stock market declines. Mr Buffett has said he is prepared to hold his investments for a long time - until they come good, says our correspondent. 点击  收听单词发音 收听单词发音

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

- 发表评论

-

- 最新评论 进入详细评论页>>